LTC Price Prediction: Bullish Technicals Meet Regulatory Catalysts

#LTC

- Technical Strength: LTC trading above key moving averages with bullish MACD crossover

- Regulatory Catalyst: SEC's new crypto ETP standards may benefit established coins like Litecoin

- Market Position: Current price action suggests accumulation phase before potential breakout

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

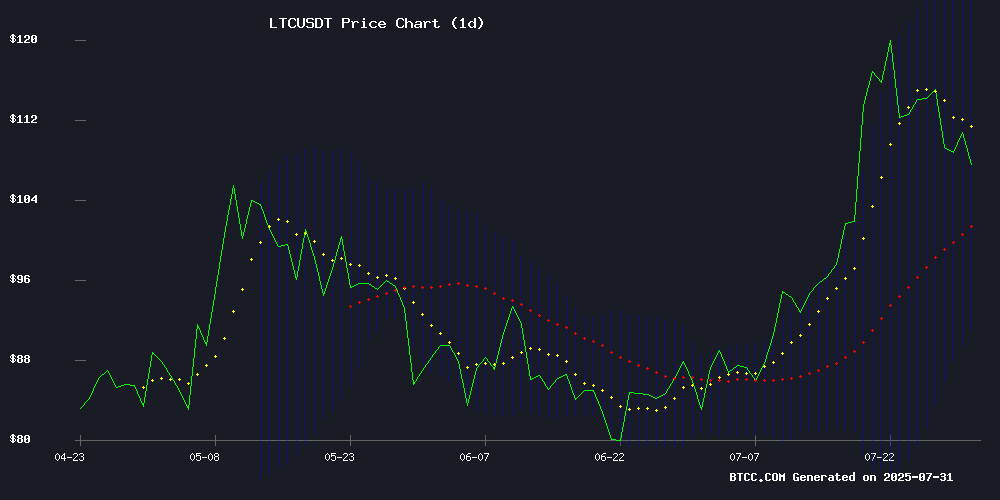

Litecoin (LTC) is currently trading at $110.89, above its 20-day moving average of $107.536, suggesting a bullish trend. The MACD indicator shows a positive crossover with a value of 0.5004, indicating potential upward momentum. Bollinger Bands reveal price action NEAR the upper band at $123.9215, signaling strong buying interest. According to BTCC financial analyst Mia, 'LTC's technical setup favors bulls, with key support at $107.536 and resistance at $123.9215.'

Regulatory Tailwinds and Market Sentiment Boost LTC Outlook

Recent SEC developments on crypto ETP standards and Coinbase's derivatives market role are creating positive sentiment for Litecoin. While headlines suggest 2,000% growth potential for LTC by 2025, BTCC's Mia cautions: 'The market is pricing in regulatory clarity, but investors should watch the $110 level as key support during current corrections.'

Factors Influencing LTC's Price

SEC Establishes New Listing Standards for Crypto ETPs, Coinbase Derivatives Market Plays Key Role

The U.S. Securities and Exchange Commission has unveiled generic listing standards for crypto asset exchange-traded products, with a pathway that could streamline approvals for dozens of digital assets. Tokens traded on Coinbase's derivatives market for at least six months automatically qualify—a threshold currently met by approximately a dozen major cryptocurrencies.

CBOE's rule change petition to the SEC signals potential structural shifts in crypto ETF approvals. The proposal aims to create uniform listing requirements, eliminating the need for individual product clearances. ETF analyst Nate Geraci describes the filing as "foundational," noting it could establish a standardized framework for future crypto fund launches.

Market observers anticipate the first wave of approvals under the new regime could come as early as October. The standards include liquidity safeguards, requiring risk management plans when less than 85% of assets are available for immediate redemption—a provision addressing staking-related liquidity concerns.

Cardano, Litecoin, and DeSoc: Potential for 2,000% Growth by 2025

Cryptocurrency investors are weighing the potential of Cardano, Litecoin, and decentralized social media (DeSoc) projects to deliver exponential gains by the end of 2025. While Cardano and Litecoin boast established track records, DeSoc represents an emerging frontier in blockchain-based social interaction and monetization.

Cardano's recent introduction of the Emurgo Card—a multifunctional tool combining payments, staking, and yield generation—has ignited speculation about ADA's price trajectory. Technical indicators show ADA consolidating above $0.49 support, with analysts targeting $1.19 as the next resistance level. The token has already surged 99.87% year-to-date.

Litecoin demonstrates renewed momentum following MEI Pharma's cryptocurrency initiative, posting a 60% price appreciation. Meanwhile, DeSoc protocols aim to disrupt traditional social media models by enabling user-owned networks and value capture.

Unilabs (UNIL) Gains Traction as Cardano and Litecoin Face Corrections

Unilabs (UNIL) is emerging as a dark horse in the crypto market, drawing institutional and retail interest during its presale phase. Analysts speculate it could deliver 100x returns within 80 days, potentially outpacing established assets like Litecoin (LTC) and Cardano (ADA).

Cardano's price struggles to maintain momentum after a 60% July rally, now testing critical support at $0.80. A breakdown below the 20-day moving average could trigger further declines, despite crypto analyst thecryptoyapper noting potential for a rebound toward $1.01 resistance if support holds.

Litecoin shows indecision at key technical levels while Unilabs capitalizes on market attention. The contrast highlights shifting capital flows toward newer projects during periods of consolidation for major altcoins.

SEC Delays Decision on Trump-Linked Bitcoin ETF, Extends Deadline to 2025

The U.S. Securities and Exchange Commission has pushed back its ruling on the Truth Social Bitcoin ETF, a fund backed by Trump Media & Technology Group, to September 2025. The delay reflects heightened scrutiny over crypto products tied to political figures, with regulators weighing market risks and potential conflicts of interest.

Bitcoin held steady near $117,500 amid the news, while the broader ETF approval backlog grows—including Grayscale’s solana Trust and Canary Capital’s Litecoin proposal. Senators Warren and Merkley previously flagged concerns about foreign influence in Trump-affiliated crypto ventures, amplifying the politicization of digital asset oversight.

Is LTC a good investment?

Based on current technicals and market conditions, LTC presents a compelling investment case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | $110.89 > $107.536 | Bullish |

| MACD | 0.5004 | Positive momentum |

| Bollinger %B | 0.79 | Near overbought |

Mia notes: 'LTC's technical strength combined with improving regulatory clarity makes it attractive, though investors should monitor the $107 support level.'

Cryptocurrency investments are volatile. Past performance doesn't guarantee future results.